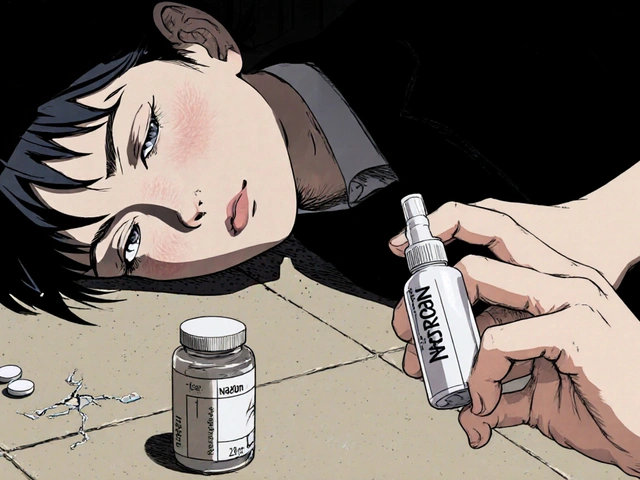

When a patient takes a drug like warfarin, phenytoin, or levothyroxine, the difference between a safe dose and a dangerous one can be as small as a few milligrams. These are NTI generics - narrow therapeutic index drugs - where even tiny variations in how the body absorbs the medicine can lead to serious harm or treatment failure. That’s why regulators around the world don’t treat them like regular generics. The rules are tighter, the testing is more intense, and the consequences of getting it wrong are life-or-death.

Why NTI Generics Need Special Rules

Most generic drugs are considered bioequivalent if their blood levels fall within 80-125% of the brand-name version. For NTI drugs, that’s not enough. The FDA tightened the standard to 90-110% for bioequivalence, and in some cases even tighter. Why? Because with drugs like digoxin, a 10% drop in blood concentration might mean the heart stops responding. A 10% spike could cause toxicity, irregular heartbeat, or even death.

It’s not just about the dose. The formulation matters too. A generic version of levothyroxine might use a slightly different filler or coating. For most drugs, that’s fine. For NTI drugs, it can throw off absorption. That’s why regulators demand more detailed dissolution testing - often multiple time points across different pH levels - to make sure the drug behaves the same in the body, no matter who makes it.

The U.S. Approach: Tight Limits, Patchwork Laws

The U.S. Food and Drug Administration (FDA) has been the global leader in setting strict standards for NTI generics since 2010. They require:

- Quality assay limits of 95-105% (vs. 90-110% for non-NTI drugs)

- Bioequivalence ranges of 80-125% or tighter, depending on the drug

- Studies conducted in healthy volunteers, not patients, to reduce variability

- Extensive stress testing for stability and degradation

But here’s the catch: the FDA approves the drug, but states decide whether pharmacists can swap it for the brand. Twenty-six U.S. states have special rules for NTI drugs. North Carolina requires a doctor and patient to sign off before switching. Connecticut and Illinois demand extra notifications for anti-seizure drugs. In some places, pharmacists can’t substitute at all without explicit permission.

That creates confusion. A 2019 survey found 67% of U.S. pharmacists get frequent requests from doctors to avoid substituting NTI generics - especially for levothyroxine and warfarin. Even when the FDA says a generic is equivalent, prescribers and patients still worry. One pharmacist on Reddit shared three cases this year where patients had abnormal thyroid levels after switching generics - even though the products were approved.

Europe: Fragmented System, Stronger Price Controls

In Europe, the European Medicines Agency (EMA) doesn’t have one single rulebook. Instead, there are three paths: the Centralized Procedure (CP), National Procedures (NP), and Mutual Recognition. The CP is faster - about 210 days - and leads to approval across the EU. But most NTI generics still go through national routes, which can take 12 to 18 months and vary wildly from country to country.

What’s unique about Europe is how prices are handled. In 24 of 27 EU countries, governments control generic drug prices. Spain, for example, forces the first generic to be priced at least 40% below the brand. Later generics must match or undercut that. That drives down costs - but it also means manufacturers cut corners to stay profitable. The EMA has responded by demanding higher-quality data, especially for complex formulations like extended-release tablets.

Still, pharmacists face confusion. A 2022 survey found 58% of European hospital pharmacists struggled to know which generics could be substituted in which country. A drug approved under the Decentralized Procedure in Germany might not be recognized in Italy. That lack of harmonization creates real risks for patients traveling or moving between countries.

Canada and Japan: Practical Flexibility

Health Canada takes a pragmatic approach. If a foreign reference product (say, the U.S. brand) is more available than the Canadian one, manufacturers can use it for bioequivalence studies - as long as they prove it’s identical in formulation, solubility, and physical properties. That’s smart. It avoids delays when the local brand isn’t on the market.

Japan’s Pharmaceuticals and Medical Devices Agency (PMDA) is known for its meticulous detail. They’ve published specific guidance for topical NTI drugs - a rare move globally. Their testing protocols are among the most rigorous, with strict requirements for particle size, viscosity, and release profiles. It’s slow, but it’s reliable. Japanese regulators don’t accept shortcuts.

The Global Push for Harmony

There’s a growing recognition that this patchwork system doesn’t work. Patients don’t care about borders. Manufacturers shouldn’t have to run 10 different sets of tests for the same drug. That’s why the International Generic Drug Regulators Pilot (IGDRP) was created in 2012. It includes the U.S., EU, Canada, Japan, South Korea, Switzerland, Taiwan, and Singapore. Their goal? Align standards where possible.

Progress is happening. In 2023, the ICH adopted Guideline M9, which opens the door to biowaivers for certain NTI drugs based on their solubility - a big step toward reducing unnecessary testing. The FDA is also moving toward population bioequivalence studies by 2025, which could better predict real-world performance than traditional methods.

But challenges remain. Only four major regulators - the U.S., EU, Canada, and Japan - have clear NTI-specific guidance. Brazil, Mexico, Singapore, and South Korea still lack detailed rules. That means manufacturers might get approval in one country but face rejection in another - even if the product is identical.

Who’s Making These Drugs? And How Much Does It Cost?

The global NTI generics market was worth $48.7 billion in 2022 and is expected to hit $72.3 billion by 2027. The U.S. leads with 42% of sales, followed by Europe at 34%. Teva is the top player, with nearly 19% of the market. Mylan, Sandoz, and Hikma round out the top four.

But developing an NTI generic isn’t cheap. It takes 18 to 24 months and $5-7 million - nearly double the cost of a regular generic. Why? Because you need more volunteers, more testing, more analytical methods, and more regulatory back-and-forth. The FDA rejects 22% more NTI applications than non-NTI ones - mostly because of bioequivalence issues.

Companies that succeed early engage with regulators before they even start testing. The FDA’s Complex Generic Drug Product Development Meetings and EMA’s Scientific Advice programs can shave off 30-45 days from approval time. That’s money saved and patients helped faster.

What’s Next for NTI Generics?

The future is about smarter science and more collaboration. The FDA’s GDUFA III, launched in 2023, includes new requirements for post-market monitoring of NTI drugs. That means tracking real-world outcomes - not just lab results. If a generic version starts showing higher rates of adverse events, regulators can act fast.

Experts agree: harmonization is the only way forward. If the EU, U.S., and Canada can align their bioequivalence standards, manufacturers won’t need five different sets of data. Patients will get consistent, safe products no matter where they live. And prices? They’ll likely drop further as competition grows - but only if quality stays high.

For now, the message is clear: NTI generics aren’t just cheaper versions of brand drugs. They’re precision instruments. And like any precision instrument, they need exact calibration - and careful handling - to work safely.

Linda Caldwell

December 17, 2025 AT 09:53NTI generics aren't just pills-they're life-or-death precision tools. I've seen patients crash after a switch and it's terrifying. We need better labeling, not just approval.

Radhika M

December 19, 2025 AT 00:04In India, we don't have special rules for NTI drugs yet. But we see patients with thyroid issues after switching generics. The problem is real even where regulations are weak.

Salome Perez

December 19, 2025 AT 20:13The global patchwork is a medical ethics nightmare. Imagine a diabetic in Berlin switching to a generic approved in Poland, then moving to Milan where it’s banned-and no one tells them. This isn’t just regulatory inefficiency. It’s systemic negligence wrapped in bureaucratic jargon.

Harmonization isn’t a luxury. It’s a human right. If we can send satellites to Mars, we can align dissolution profiles across borders.

The FDA’s 90-110% standard? Brilliant. But without global adoption, it’s just a beautiful lighthouse in a stormy sea-visible, but powerless to guide all ships.

And let’s not pretend cost-cutting is the villain. It’s the lack of enforcement. A company can shave $2M off testing and still make a profit. But when a patient’s INR spikes because of a filler change? That’s not a cost-it’s a catastrophe.

Why don’t we require batch-specific bioequivalence certificates? Why not QR codes on packaging linking to full dissolution data? We have the tech. We just lack the will.

Regulators need to stop treating NTI drugs like aspirin. They’re not interchangeable. They’re choreographed dances between chemistry and physiology. One wrong step, and the patient falls.

IGDRP is a start. But let’s be honest: until the pharmaceutical industry pays for global compliance audits-not just local filings-we’re just rearranging deck chairs on the Titanic.

And yes, I’ve read the ICH M9 guidelines. Biowaivers are promising. But only for drugs with perfect solubility profiles. For levothyroxine? Not a chance. Not yet.

Let’s stop calling them generics. They’re precision therapeutics. Rename them. Rebrand them. Make the public understand: this isn’t about price. It’s about survival.

Jessica Salgado

December 19, 2025 AT 22:16I work in a pharmacy. Last month, a 72-year-old man came in in a panic-his heart was racing after his pharmacist switched his digoxin generic. He’d been stable for 4 years. The new one? Same FDA approval. Same label. But the fillers were different. He almost died.

Doctors don’t know the difference between generics. Pharmacists are stuck in the middle. Patients? They just want to live.

We need a national registry. Every NTI generic, every batch, every change. Like a food recall system-but for life.

CAROL MUTISO

December 20, 2025 AT 07:39Oh, so now we’re treating drugs like fine wine? ‘Ah yes, this levothyroxine has notes of lactose and a hint of microcrystalline cellulose-perfectly balanced.’

Let’s be real: the FDA’s ‘tighter standards’ are just a PR stunt. Most NTI generics are made in the same factories, with the same equipment, just different labels. The real issue? Doctors who refuse to trust anything but brand-name, and pharmacists who don’t know the difference between a filler and a coating.

Meanwhile, in Germany, a patient gets a cheaper version and lives. In Illinois? They need a signed form from their priest. This isn’t science. It’s theater.

Naomi Lopez

December 22, 2025 AT 02:12The notion that NTI generics are ‘equivalent’ is a dangerous myth perpetuated by regulatory capture. The 90-110% bioequivalence window is statistically absurd for drugs with a half-life under 12 hours. The FDA’s own data shows 18% of patients experience clinically significant fluctuations after substitution.

And yet, we’re told to ‘trust the science.’ Which science? The science funded by manufacturers who profit from volume, not precision? The same science that once claimed cigarettes were safe?

The real scandal isn’t the lack of regulation-it’s the institutionalized denial. We have the tools to test at the molecular level. We have the technology to track drug absorption in real time via wearable sensors. But we choose convenience over competence.

Until we treat NTI drugs like insulin or anticoagulants-i.e., as life-critical interventions, not commodities-we are not healing. We are gambling.

And let’s not pretend the EMA is better. Their ‘mutual recognition’ is a bureaucratic farce. A drug approved in France is deemed ‘unstable’ in Austria because of humidity differences in storage. That’s not science. That’s superstition dressed in lab coats.

The solution? Ban all NTI substitutions unless the patient consents in writing, the prescriber approves the specific batch, and the pharmacy provides a digital certificate of dissolution profile. Simple. Safe. Necessary.

But no. We’ll keep letting pharmacists swap pills like trading cards. And we’ll keep calling it progress.

Erik J

December 23, 2025 AT 10:50Just curious-how many of the NTI generics that pass FDA testing are actually manufactured in the same facility as the brand? I’ve seen reports where the ‘generic’ is made on the same line, same equipment, just different packaging. If that’s true, why the fuss over ‘bioequivalence’?

Raven C

December 24, 2025 AT 00:15It’s appalling. The FDA’s ‘tighter’ standards are still laughably inadequate. You’re telling me that a 10% fluctuation in digoxin concentration is ‘acceptable’? That’s not bioequivalence-that’s clinical roulette. And now we’re letting pharmacists switch them without consent? This isn’t healthcare. It’s negligence masquerading as cost-efficiency.

And don’t get me started on the ‘global harmonization’ fantasy. The EU? A bureaucratic quagmire. Canada? Too soft. Japan? Overly rigid. Who’s really protecting patients? No one.

What we need is a global NTI registry-every batch, every excipient, every dissolution curve-publicly accessible. No more blind trust. No more ‘it’s approved.’ Patients deserve transparency, not bureaucracy.

And if you think this is overblown, ask the family of the 68-year-old who died after switching to a ‘bioequivalent’ levothyroxine. They didn’t know the difference. Neither did the pharmacist. Neither did the regulator.

amanda s

December 25, 2025 AT 11:41USA is the only country that actually cares about patient safety. Europe lets big pharma cut corners. India? They sell generics made in sewage. Japan? Too slow. Canada? Too lazy. We’ve got the gold standard. Stop comparing us to third-world regulators.

Chris Van Horn

December 26, 2025 AT 04:49Y’all are overthinking this. It’s a pill. If your thyroid doesn’t work after a switch, you’re just weak. I switched my warfarin generic and my INR didn’t budge. Your doctor’s just scared of generics because they get kickbacks from the brand. Wake up.

Also, the FDA is corrupt. They approve junk because Big Pharma pays them. That’s why they ‘tightened’ the standards-so they could charge more for ‘special’ testing. It’s all a scam.

And if you think Japan’s rules are ‘rigorous,’ you’ve never seen a Chinese factory. They make better pills in a garage than most ‘regulated’ companies do.

Virginia Seitz

December 26, 2025 AT 16:04So… if my grandma switches generics and feels weird, what’s the fix? 😔

Evelyn Vélez Mejía

December 27, 2025 AT 17:24The entire framework of bioequivalence is built on a flawed assumption: that all patients are statistically identical. But humans are not data points. We metabolize differently. We have different gut flora, different liver enzymes, different stress levels. A drug that’s ‘bioequivalent’ on average may be lethal for one individual.

Regulators treat NTI drugs as if they’re math problems. They’re not. They’re biological symphonies-and even the smallest note out of tune can shatter the entire piece.

We don’t need tighter standards. We need personalized medicine. We need pharmacogenomic testing before prescribing any NTI generic. We need to move from population-based equivalence to individualized safety.

But that’s expensive. And inconvenient. And it doesn’t fit into the current profit-driven healthcare model.

So we keep pretending that a pill labeled ‘bioequivalent’ is safe for everyone. And we keep burying the people who prove us wrong.

The real question isn’t how we regulate NTI generics-it’s whether we’re willing to stop treating patients like variables in a regression model.

Peter Ronai

December 29, 2025 AT 01:36Everyone’s acting like this is some groundbreaking revelation. Newsflash: NTI drugs have always been dangerous. The FDA just finally admitted it. But now we’re making it into a crisis? The real crisis is that people think a pill is a pill. It’s not. It’s chemistry. And chemistry doesn’t care about your feelings.

And don’t get me started on ‘harmonization.’ The EU can’t even agree on which side of the road to drive on. You think they’ll agree on dissolution profiles? Please. This is just regulatory virtue signaling.

The only thing that matters? Patient outcomes. If a generic works, use it. If it doesn’t, switch back. No forms. No bureaucracy. Just medicine.

Stop overcomplicating it. Patients don’t need white papers. They need functional drugs. And the market will sort it out. Always has.

Linda Caldwell

December 29, 2025 AT 04:25Exactly. My cousin switched to a new generic levothyroxine and her TSH went from 2.1 to 8.9 in two weeks. No symptoms at first. Then fatigue, weight gain, depression. She didn’t even connect it to the switch. Took her three months to figure it out.

Pharmacists need to be trained. Not just to fill scripts, but to recognize the signs.