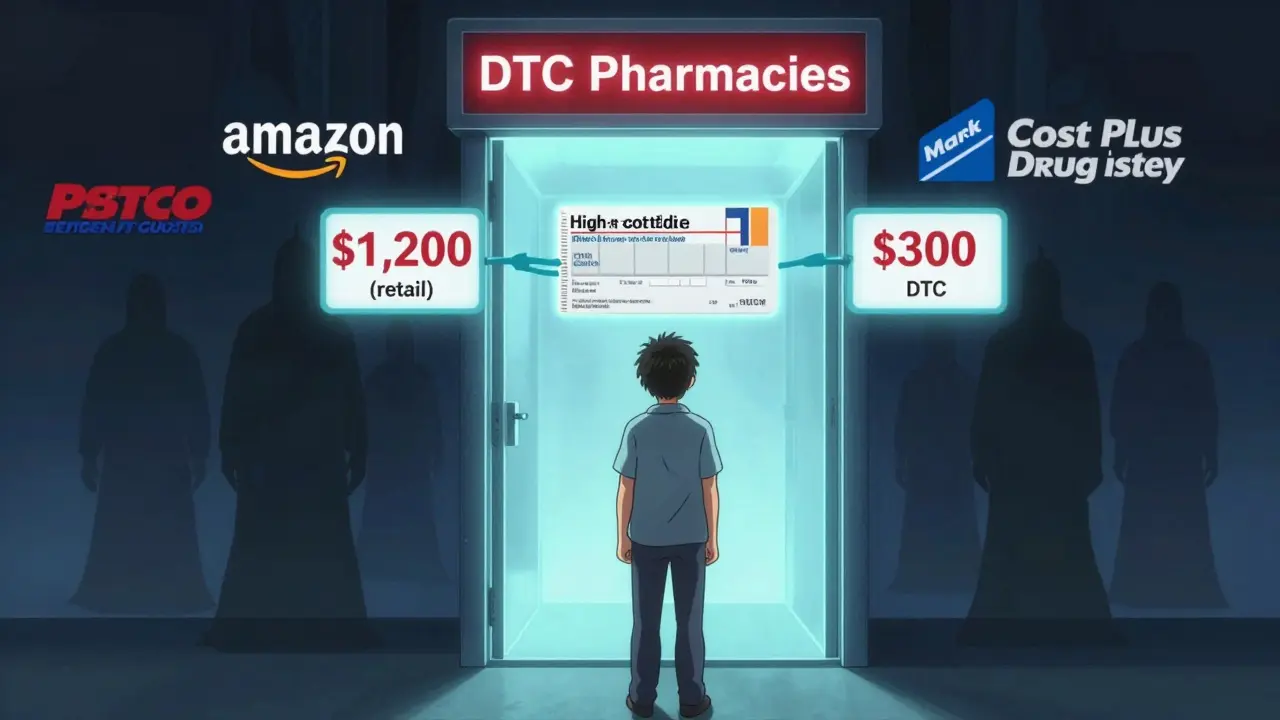

Buying prescription drugs without insurance used to mean paying full retail price - often $100, $200, or more for a 30-day supply. But since 2020, a new option has popped up: direct-to-consumer (DTC) generic pharmacies. These are online pharmacies like Mark Cuban Cost Plus Drug Company, Amazon Pharmacy, Costco, and Walmart that sell medications at transparent, cash-only prices. No insurance needed. No pharmacy benefit manager (PBM) middlemen. Just cost plus a fixed markup. Sounds perfect, right? Especially if you’re uninsured, underinsured, or tired of surprise bills. But here’s the catch: they don’t always save you money. Sometimes, they cost more. And sometimes, they don’t even carry the drug you need.

How DTC Pharmacies Work (And Why They’re Different)

Traditional pharmacies rely on PBMs - middlemen that negotiate drug prices between insurers, manufacturers, and pharmacies. These deals are secret. You might pay $80 for a generic drug while your insurer pays $120. The PBM keeps part of that difference as a rebate. You never see it. DTC pharmacies cut out the middleman. They buy drugs in bulk, add a fixed markup (like 15%), and sell it to you outright. Mark Cuban Cost Plus Drug Company, for example, lists the exact cost they paid for a drug, plus their 15% fee. No hidden fees. No rebates. No surprise charges. That’s why prices are often way lower - especially for expensive generics.When DTC Pharmacies Save You Big Time

A 2024 study in the Journal of General Internal Medicine looked at 100 of the most common and most expensive generic drugs in Medicare Part D. The results were clear: for the top 50 most expensive generics, DTC pharmacies saved people an average of $231 per prescription. That’s a 76% drop in price. For drugs like insulin, antivirals, or high-cost antibiotics, the savings can be life-changing. Amazon Pharmacy had the lowest price on 47% of these expensive drugs. Mark Cuban Cost Plus Drug Company came in second at 26%. Costco? Only 13%. But here’s the twist: those same pharmacies didn’t save you much on common generics. For drugs like metformin, lisinopril, or atorvastatin, the savings were just $19 on average. That’s still 75% cheaper than retail, but not enough to justify the hassle - unless you’re paying out-of-pocket.The Hidden Problem: They Don’t Carry Everything

Here’s where things get messy. One-fifth of the most expensive generic drugs aren’t available on any major DTC pharmacy website. That means if you’re on a specialty drug like mycophenolate mofetil (used after organ transplants) or a high-dose antiviral, you won’t find it on Amazon, Mark Cuban’s site, or Costco. The 2024 study found that Mark Cuban Cost Plus Drug Company only carried 33 out of 79 neurological generics studied. CVS Health’s own research showed that for neurological drugs, switching to DTC pharmacies could actually increase out-of-pocket costs by $82 million across all users. Why? Because insured patients on good plans often pay $5-$15 for these drugs through their PBM. DTC pharmacies don’t have them. So you’re stuck paying full price - or going back to your old pharmacy.

Who Wins? Who Loses?

If you’re uninsured and need a high-cost generic - say, a $1,200 monthly drug that’s now $300 on Amazon - DTC pharmacies are a godsend. You’re saving hundreds. If you’re on Medicare Part D and your plan has a high deductible, paying cash at Costco for $15 might be smarter than using your insurance and hitting your deductible. But if you’re on a good commercial plan with low copays, you might be better off sticking with your usual pharmacy. The USC Schaeffer Center found that 90% of commonly prescribed generics in Medicare Part D cost less than $20 at Costco - even without insurance. So if you’re already getting $5 copays through insurance, why bother?Price Comparison: Real Numbers from Real Drugs

| Drug Type | Lowest-Cost Pharmacy | Average Savings vs Retail | Availability Rate |

|---|---|---|---|

| Expensive Generics (top 50 by cost) | Amazon Pharmacy (47%) | $231 (76% savings) | 80% available across DTC sites |

| Common Generics (top 50 by volume) | Costco (31%) | $19 (75% savings) | 95% available across DTC sites |

| Neurological Generics | Insurance (often cheaper) | DTC prices higher on 67% of drugs | Only 42% available on Mark Cuban’s site |

Let’s say you need a 30-day supply of warfarin (a blood thinner). At your local CVS, you pay $12 with insurance. At Amazon, it’s $10. At Costco, it’s $8. At Mark Cuban’s site? $9. You’d pick Costco. But what if you need mycophenolate? You won’t find it on any DTC site. You’ll have to go to your pharmacy - and pay $150 with insurance. That’s still better than paying $300 out-of-pocket. So DTC pharmacies aren’t a replacement. They’re a supplement.

The Real Cost: Time and Effort

You can’t just pick one DTC pharmacy and call it done. You have to check each one for each drug. That’s five websites to visit. Five formularies to compare. Five shipping times to weigh. If you take five different medications? That’s 25 price checks a month. For many people, that’s not worth the $19 savings. Dr. Hatim Lalani, lead author of the 2024 study, put it bluntly: “There are no simple, accurate, and comprehensive tools to help patients identify the lowest-cost generic drug across all pharmacy options.” No app. No website. No browser extension. Just you, your phone, and a lot of tabs.What Should You Do?

Here’s how to make smart choices without losing your mind:- If you’re uninsured or have a high-deductible plan, check Amazon and Costco first for expensive drugs. You might save hundreds.

- If you’re on insurance with low copays, stick with your current pharmacy. Don’t switch unless you’re paying full price.

- If you need a specialty drug, call your insurance first. Your PBM might already have it at $5.

- For common generics like metformin or simvastatin, Costco is usually the cheapest - even without insurance.

- If you’re price-sensitive and have time, use GoodRx to compare cash prices at local pharmacies and DTC sites. It’s not perfect, but it’s better than nothing.

The Bigger Picture: Is This the Future?

DTC pharmacies aren’t going away. They’re a reaction to decades of opaque pricing, rebate games, and insurer leverage. But they’re not a silver bullet. They help some people - a lot, in some cases - but they leave others behind. The real win would be a system where everyone, insured or not, can see the true price of a drug in real time. Until then, you’re stuck playing a game where the rules change with every prescription. And you’re the one doing the work.Bottom line? DTC pharmacies aren’t about replacing insurance. They’re about giving you a backup plan. And if you’re paying full price anyway? That backup plan could save you thousands.

Are DTC pharmacies cheaper than using insurance?

It depends. For expensive generics, DTC pharmacies often win - sometimes by hundreds of dollars. For common generics, savings are small ($10-$20). But if your insurance gives you a $5 copay, you’re better off using it. DTC pharmacies are best for people who pay full price, have high deductibles, or are uninsured.

Can I use DTC pharmacies if I have Medicare Part D?

Yes, and you should compare prices. Medicare Part D plans vary widely. Some charge high copays for certain drugs. Others have coverage gaps. If you’re paying $100+ out-of-pocket for a drug, check Amazon, Costco, or Mark Cuban’s site. You might find it for $30. But if your plan already covers it for $5, stick with it.

Why don’t DTC pharmacies carry all drugs?

Many expensive drugs are made by small manufacturers with limited supply. DTC pharmacies buy in bulk and need predictable pricing. If a drug is hard to source, has low demand, or is subject to supply shortages, they often skip it. That’s why neurological, transplant, and rare disease drugs are frequently missing.

Is Amazon Pharmacy really the cheapest?

For expensive generics, yes - Amazon had the lowest price on nearly half of them in a 2024 study. But for common generics, Costco was cheaper more often. Prices change weekly. Always compare.

Should I stop using my insurance and go cash-only?

No - unless you’re paying full price anyway. Insurance isn’t just about the copay. It’s about coverage limits, annual out-of-pocket maximums, and access to specialty drugs. Using DTC pharmacies as a backup for specific drugs is smart. Replacing your insurance entirely? That’s risky.

Alex Ogle

February 9, 2026 AT 13:41Look, I’ve been using Mark Cuban’s site for my insulin for a year now. Saved me $400 a month. No drama. No insurance red tape. But here’s the thing - I had to spend three afternoons comparing prices across five sites, calling pharmacies, and reading tiny print about shipping times. It’s not just about the price. It’s about the mental tax. I’m not a pharmacist. I’m not a data analyst. I just want my meds without having to file a tax return every time I need a refill.

And don’t get me started on the neurological drugs. My sister needs mycophenolate. She’s on Medicare. Her copay is $12. DTC? Not available. So she pays $12. I pay $300 out-of-pocket for my stuff. We’re both stuck in different versions of the same broken system. No one wins. Just different flavors of frustration.

It’s not that DTC is bad. It’s that the whole damn system is designed to confuse you. And if you’re tired, sick, or poor? You lose. Always.

Tatiana Barbosa

February 10, 2026 AT 23:53Yessss this is the future!!! DTC pharmacies are the middle finger to PBMs and Big Pharma’s sleazy rebate games 🙌

Stop using insurance like it’s a magic wand - it’s not. It’s a labyrinth with hidden fees and surprise deductibles. If you’re paying $15 for metformin anyway? Cash is cleaner. Faster. Transparent. Amazon and Costco are quietly revolutionizing healthcare without asking for permission.

And if you’re not comparing prices? You’re leaving money on the table. $19 savings doesn’t sound like much until you realize that’s $228 a year. That’s a weekend trip. Or a new pair of shoes. Or a damn massage after working two jobs.

Stop overcomplicating it. Check GoodRx. Check Costco. Check Amazon. Do the 5-minute drill. Your future self will high-five you.

PS: I started a spreadsheet. 12 drugs. 3 pharmacies. Saved $800 last quarter. You can too. 💪

Simon Critchley

February 11, 2026 AT 07:12Oh sweet merciful heavens, another ‘DTC saves money’ piece. Let’s unpack this with actual pharmacoeconomics, shall we? 🧐

First, the 76% savings on expensive generics? That’s cherry-picked. Those are the drugs PBMs *deliberately* inflated to extract rebates. Of course DTC crushes them - they’re not part of the rebate game. But here’s the kicker: DTC pharmacies don’t have economies of scale for *low-volume, high-complexity* drugs. That’s why neurological agents are missing. Supply chains are fragmented. Manufacturers won’t sell bulk to Amazon because they’re locked into PBM contracts.

Second, ‘Costco is cheapest for common generics’? Only if you’re in a state that allows cash sales without pharmacy licensing hoops. In NY? You can’t even buy lisinopril at Costco without a prescription scan. In Texas? Easy. So geographic arbitrage is real. And no one talks about it.

Third - GoodRx? It’s a PBM affiliate. They get paid when you use their links. They’re not your friend. They’re a middleman with better branding.

TL;DR: DTC isn’t the future. It’s a patch on a leaking roof. The real fix? Single-payer price negotiation. But hey, enjoy your spreadsheet, Karen.

Karianne Jackson

February 12, 2026 AT 23:23I tried DTC. It was a nightmare. I waited 10 days for my blood pressure med. Then it was the wrong dosage. Called customer service. Got a bot. Gave up. Went back to CVS. Paid $10. Felt like a queen. 🏰

Andy Cortez

February 14, 2026 AT 02:56Y’all are overthinking this. DTC pharmacies? They’re just another scam. Amazon doesn’t care about your health. They care about your data. Mark Cuban? He’s a billionaire who got rich selling candy. He’s not your savior. He’s a marketer. And that ‘cost plus 15%’? Bullshit. They’re buying in bulk from the same suppliers as PBMs - just with a different label. The ‘transparency’ is a marketing stunt.

And don’t even get me started on GoodRx - that’s where the rebates go. They’re the *real* middlemen. They just dress it up like a nonprofit.

Insurance is still better. You think you’re saving money? You’re just being played by a different set of sharks. 🦈

Jessica Klaar

February 14, 2026 AT 19:51I’m a nurse in rural Ohio. I see this every day. People come in with 3-4 prescriptions. Some are on Medicare. Some are uninsured. Some are on Medicaid. And they’re all confused. I don’t push DTC. I don’t push insurance. I just help them compare.

Last week, a guy needed warfarin. Insurance: $12. Amazon: $10. Costco: $8. CVS cash: $14. He picked Costco. Didn’t have a membership? I showed him how to get a $55 annual one - paid for itself in one refill.

It’s not about ideology. It’s about access. And if you have time, patience, and a smartphone? You can win. Not everyone does. But for those who can? It’s a quiet revolution. And I’m glad it’s here.

Just don’t tell them it’s perfect. Tell them it’s an option. And that’s enough.

Patrick Jarillon

February 15, 2026 AT 09:31Let me guess - you all think this is about ‘saving money.’ WRONG.

This is a Trojan horse. DTC pharmacies? They’re the first step to privatizing ALL healthcare. Amazon gets your health data. Mark Cuban gets your trust. Then they start charging for ‘premium access.’ Next thing you know, your insulin is only available if you subscribe to Prime Health. And if you can’t pay? Too bad.

They’re not here to help. They’re here to replace the system so they can own it. And once they do? Prices will go UP. Because monopolies always do.

Remember when Netflix started? ‘$8/month!’ Now it’s $24. And you can’t even watch the shows without 3 subscriptions.

This is the same playbook. Wake up.

PS: The government’s been hiding drug prices for decades? Yeah. But letting billionaires do it? That’s worse.

John Watts

February 17, 2026 AT 09:18Hey, I’ve been helping seniors navigate this for years. And I’ll tell you what works: a simple rule.

If you’re paying more than $20 out-of-pocket for a drug? Check DTC.

If you’re paying less than $10 with insurance? Stay.

If you’re on 5+ meds? Use GoodRx + a spreadsheet. Takes 20 mins/month.

It’s not sexy. It’s not revolutionary. But it works.

And for the love of god, don’t let anyone tell you this is ‘the future.’ It’s just a tool. Like a hammer. Use it if it fits. Don’t worship it.

And if you’re worried about privacy? Use a burner email. Don’t link it to your Amazon account. Easy.

Healthcare doesn’t need a hero. It needs a toolkit. And you just got one.

Randy Harkins

February 18, 2026 AT 02:21Just wanted to say thank you for writing this. 💙

I’m 68, on a fixed income, and I’ve been paying $180/month for my cholesterol med until I found Costco. Now it’s $7. I cried. Not because I saved money - because I didn’t have to choose between food and meds anymore.

I didn’t know about DTC until my granddaughter showed me. She’s 22. She’s smarter than half the politicians.

We need more of this. Not less.

And yes, it’s a pain to compare. But it’s worth it. Every single time.

Chima Ifeanyi

February 19, 2026 AT 18:44Let’s cut through the noise. The real issue isn’t DTC vs insurance. It’s that the U.S. pharmaceutical supply chain is a feudal system where manufacturers, PBMs, and pharmacies play musical chairs with your money.

DTC pharmacies? They’re not innovators. They’re arbitrageurs. They exploit regulatory loopholes - like buying from Canadian wholesalers or using bulk contracts with manufacturers who aren’t bound by U.S. pricing rules.

Meanwhile, the same drugs sold in Germany or Canada are 60% cheaper - because those countries negotiate prices. We don’t. We let corporations do it for us - and they screw us.

So yes, DTC saves you money. But only because the system is broken. Fix the system. Don’t just patch it with Amazon.

Tori Thenazi

February 20, 2026 AT 22:41Wait… so you’re telling me… that Amazon… is secretly running a pharmacy… and they’re not telling us… what they’re doing with our health data??

And Mark Cuban? He’s not even a doctor! He’s a TV guy! What if he’s selling fake drugs?!

And what if the government is using this to track us??

I read on a forum that the CDC is already collecting DTC purchase logs to build a national health database… and then they’ll use it to… I don’t know… stop us from buying certain meds??

My cousin’s neighbor’s dog got sick after taking a DTC pill. It died. The vet said it was ‘unregulated.’

What if my insulin has a microchip??

What if they’re putting fluoride in it??

What if this is all a distraction from the real issue - the 5G towers in pharmacies??

WE NEED TRANSPARENCY. AND A LIE DETECTOR.

Also: I heard Costco is owned by the Illuminati. Just saying.

Elan Ricarte

February 22, 2026 AT 16:30Let’s be real - this whole DTC thing is just corporate capitalism with a smiley face.

Amazon doesn’t care if you live or die. They care if you click ‘Add to Cart’ and then leave a 5-star review. Mark Cuban? He’s not saving lives. He’s building a brand. And he’s using your desperation as a marketing tool.

And don’t get me started on GoodRx - that’s just PBM 2.0 with better UX. They’re still taking rebates. They’re just hiding it behind a ‘free savings tool’ logo.

The only people winning? The ones who wrote the algorithms that decide which drug gets listed where. The rest of us? We’re just data points in a spreadsheet. And soon? They’ll start charging us for ‘priority access’ to the drugs they decide to carry.

So yeah. Save $19 on metformin. Meanwhile, your insulin is still $300. Because they don’t want you to live. They want you to pay. And they’re winning.